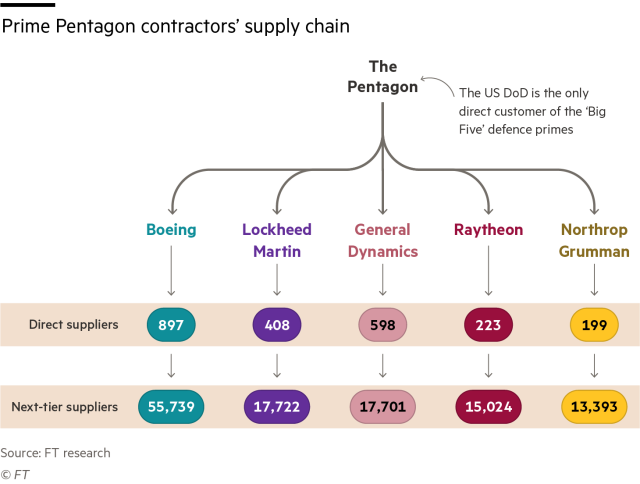

Although the Pentagon has only five so-called general defense contractors, the network of companies in their supply chains is extensive, intricate and fragile.

|

| The figure shows the number of contractors and subcontractors of the main arms manufacturers in the United States. |

| Source: FT |

Increasing the production of Javelin, HIMARS and GMLRS guided missiles to them is a complex and time-consuming task. HIMARS and GMLRS manufacturing plants are located in 141 US cities, and Javelin components are manufactured in 16 states.

Javelin and HIMARS are manufactured by the same aerospace and defense company Lockheed Martin (Javelin is a joint venture with another US defense giant, Raytheon Technologies). Along with Boeing, Northrop Grumman and General Dynamics, they are among the top five "first-class" or largest contractors that fulfill most defense contracts in the United States. Technically, the Pentagon is their only customer, since sales to other countries must go through the federal government.

In pursuit of efficiency, these defense companies have implemented the principle of "lean manufacturing" – a just-in-time delivery strategy that assumes the absence of a large number of components in stock. But this principle does not allow us to quickly increase production volumes. The Big five defense contractors are interconnected. Everyone supplies others with different programs, and everyone has their own suppliers, which means that a problem for one is a problem for all. In four Pentagon contracts, Lockheed Martin had at least 110 subcontractors for HIMARS and 60 for GMLRS in 2019, 2021 and 2022, with some organizations supporting both programs. As of mid-2023, about 50 HIMARS installations were sent to Ukraine . According to the Pentagon's budget estimate for 2023, each system costs about $6.8 million. GMLRS missiles with a range of 70 km cost $168,000 each.

The warhead for GMLRS is manufactured by General Dynamics in Niceville (Florida). Aerojet Rocketdyne and Northrop Grumman produce rocket engines for GMLRS in Camden (Arkansas) and at the Rocket Center (West Virginia). These are the only suppliers of rocket engines in the USA. Aerojet, which until 2023 was the only remaining independent manufacturer of rocket propulsion systems, is now producing a rocket engine ignition system.

Honeywell in Clearwater (Florida) produces guidance systems for GMLRS. Goodrich Aerospace, part of Raytheon Technologies, manufactures an aerodynamic rudder system for a rocket in Wolverhampton (UK). LGS Technologies manufactures a proximity sensor for a fuse in Lancaster (Texas). The wheeled chassis for HIMARS was previously manufactured by BAE Systems and Oshkosh Corporation, but is now manufactured by Lockheed Martin in Camden. Caterpillar manufactures the engine in Peoria, Illinois. L3 Harris manufactures electrical parts for the launcher, weapon interfaces, control unit and fire control system in Palm Bay (Florida). L3Harris also manufactures a location and navigation unit that helps drive the truck, and has been doing this in Budd Lake, New Jersey, until 2022. Hutchinson Industries assembles wheels and tires in Trenton (New Jersey). A total of 141 cities in 28 US states are represented in the HIMARS and GMLRS supply chains.

At the last stage, before the delivery of Himars, GMLRS and Javelins systems, the final assembly and debugging stages are carried out at Lockheed facilities in Camden, Arkansas, and Troy, Alabama.

At the beginning of last year, Lockheed produced 48 HIMARS per year, and now it has reached 60. But it will take another 18-24 months to reach the target of 90. Every company in the Big Five supply chain faces problems and shortages of spare parts, as well as personnel problems. In particular, there is a shortage of microelectronics, rocket engines, explosives, castings and forgings.

As for rocket engines, one of Raytheon's most scarce parts, "we don't see a way to restore normal supplies until the first half of 2024," CEO Greg Hayes said last October. Raytheon needs 10,000 more workers, many of whom will need security clearance.

At the moment, 8,500 Javelins have been sent to Ukraine – about a third of American stocks. Since the beginning of the war, the Pentagon has signed two contracts with Lockheed and Raytheon, which jointly produce the system, for a total of $ 620 million for the production of Javelin – it increases from 2,100 to 4,000 per year. The launcher, which costs $310,946, allows you to identify a target, aim and launch a missile. The disposable launch tube is manufactured by Northrop Grumman at the Rocket Center (West Virginia). The $263,446 rocket contains an infrared homing head manufactured by Leonardo DRS in Dallas. The missile's warhead contains two explosive charges. The first, which removes dynamic protection from Russian tanks, is produced by General Dynamics in Niceville (Florida). Aerojet Rocketdyne in Camden, produces two engines for the Javelin. The first one throws the rocket out of the launch tube, after which the second one is launched, which leads the rocket to the target. The rudders placed in the jet of the engine and four movable tail stabilizers are manufactured by General Dynamics.

The US is chronically underinvesting in ammunition, says Stacey Pettijohn, director of the CNAS defense program. They begin to react when the problem has already manifested itself. During the fight against ISIS, for example, the United States almost used up all of its Joint Direct Attack Munition(JDAM) bombs manufactured by Boeing and Hellfire missiles manufactured by Lockheed, as well as some short-range precision weapons.

Currently, there are no multi–year contracts for the purchase of ammunition, unlike ships and aircraft, which "would encourage manufacturers to invest in increasing capacity," says Mark Kanchian, senior adviser at the Center for Strategic and International Studies. The heads of defense companies would be "kicked out by shareholders" if they made decisions only based on meetings at the Pentagon and what they read in the news. "The government should report the increased demand through contracts," industry sources say.

Author's work / translation

Sources used: