The total volume of investments in the software industry by the end of 2021 amounted to 232 billion rubles, which is 2.4 times more than in 2020, RUSSOFT reported the results of an annual survey.

External sources of financing account for 26.4% of all investments in 2021 (a year earlier it was 22%). In absolute terms, they provided 61 billion rubles in 2021 — 2.9 times more than in 2020. The remaining investments were made by the IT companies themselves or their founders.

The beginning of the investment boom led to the fact that the need for investments was met by 58%, which is much more than it was at the end of 2020 (37%). This indicator is calculated as the share of actual investments from the volume of effective investments that software companies are ready to master in the presence of unlimited sources of financing. A fairly high level of satisfaction of investment needs has been achieved, given that the managers of the surveyed enterprises tend to exaggerate their capabilities.

The volume of investments in the software industry has increased due to the fact that the range of enterprises that attracted investments has significantly expanded — from 31% in 2020 to 51.5% in 2021 (from all companies surveyed by RUSSOFT specializing in software development). The share of companies that have attracted external financing has increased even more — from 7% to 21%. At the same time, on average, the volume of attracted investments per company increased from 22 million rubles to 52 million (external investments — from 4.5 million rubles to 13.6 million).

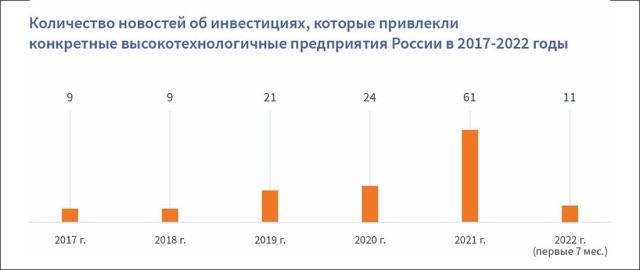

The analysis of public communications also indicates a significant increase in the volume of investments in 2021 and, in particular, the volume of external financing (a twofold and threefold increase, respectively). According to the amount of news about investments attracted by specific software companies, we can talk about a significant increase in investment activity, which began in 2019, and about a real investment boom in 2021. If we summarize the facts of investments of more than $ 1 million mentioned in various publications, then by the end of 2021 the total volume of investments should reach 54.2 billion rubles. This is about three times more than a year earlier (18.1 billion).

The number of news about investments that attracted specific high-tech enterprises in Russia in 2017-2022

It is very difficult (almost impossible) to calculate the absolute values of the volume of investments in the high-tech sphere or the size of the venture market accurately. The spread of estimates depending on the methodology used is traditionally very large. At the same time, if various sources talk about a multiple increase (for example, according to a study by the Moscow Innovation Agency, venture capital investments in Moscow in 2021 set a historical maximum, increasing their volumes more than threefold compared to 2020 — up to $ 1,794 million against $ 536 million), although in previous years somethere were no signs of a sharp increase in investment activity. It is quite possible to talk about the investment boom in the software industry revealed in 2021. At the same time, it began in 2019, then slowed down by the pandemic, but resumed again in 2020 (in the second half of the year).

However, the Association's analysts were in no hurry to draw unambiguous conclusions about the beginning of the investment boom in 2021, suggesting waiting for the results of the 2022 survey. As a result, the assumption made about the investment boom in the software development industry was confirmed.

In any division of companies into different categories, at least 41% of respondents reported attracting investments and at least 16% — external financing. The spread depending on the type of companies was not very large. They are distinguished by the more frequent availability of investments (including external financing), companies with an export share in turnover above 50%, turnover above 375 million rubles, as well as enterprises whose head offices are located in Moscow. The size of the company has a particularly strong effect on attracting foreign investment.

The percentage of surveyed companies that had investments in 2021, with a distribution by category

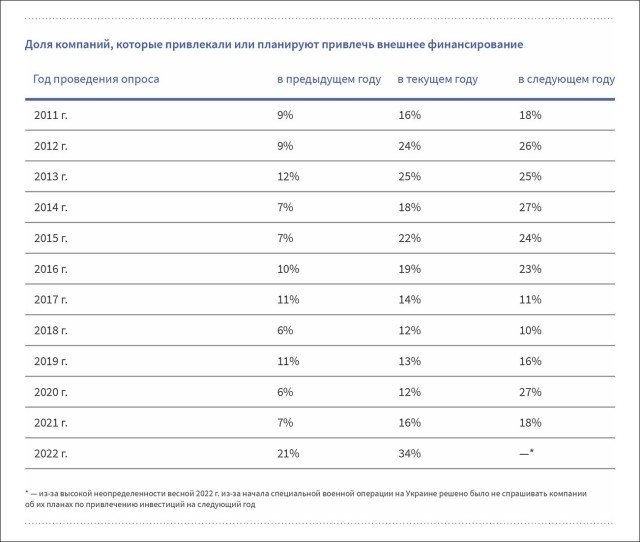

The results of 2021 in terms of comparing the forecast and the actual results were unexpected. If only 16% of the companies surveyed in 2021 expected to attract external financing in the "current year", then in fact 21% turned out to be such. In previous years, there were much fewer companies that actually received external financing than those who expected this financing (usually less than 10%).

There was a situation when investments became available to many companies that did not even plan them. This can partly be attributed to the pandemic, which accelerated the introduction of information technologies, partly to import substitution, accelerated due to sanctions and the policies of Western vendors (in any case, the need to replace foreign solutions with domestic analogues has sharply increased).

The share of companies that have attracted or plan to attract external financing

According to the results of a survey conducted in the spring of this year, 52.1% of the surveyed companies plan to attract investments in the development in 2022. It was decided not to ask about plans for the next 2023 due to the high uncertainty that arose in the spring of 2022 regarding the future of the industry, the situation in the Russian and global economy. Consequently, about the same number of software companies (the same share) indicated the availability of investment plans for 2022 as actually attracted investments in 2021.

Attention is drawn to the fact that according to the results of the 2022 survey, 34% of companies rely on external financing, while in 2021, 22% of the surveyed companies actually attracted investments. Assuming that all investment forecasts turn out to be correct, the total volume of investments in 2022 should grow by 60%, and external financing by 214%.

It is difficult to judge whether the forecasts for 2022 will be correct until the completion of the next survey of companies in 2023. On the one hand, the need for investment has not decreased, but, most likely, has increased: there are many urgent tasks related to ensuring technological sovereignty, and there is a need to reorient to new markets due to the closing markets of Western countries for Russian companies. On the other hand, several months were lost due to the fact that the development strategy had to be urgently adjusted with the radically changed situation in the Russian and foreign markets. And some foreign investment funds could curtail their work in Russia, and the boom of 2021 occurred with their notable participation.

Judging by public reports on investment activity in the high-tech sector of the Russian economy, there were no signs of growth in the first seven months of 2022. These reports indicated that by the end of the years there would be no growth, but a reduction in investment.

However, the conditions for talking about plans and attracted investments in the first half of 2022 were not the best. For example, the same foreign investors could completely abandon the publicity of their activity in Russia.

Nevertheless, it is still possible to focus on the expectations of companies, since the survey was conducted in the first months after the start of a special military operation in Ukraine, which means that respondents took into account or at least tried to take into account the high uncertainty in their forecasts.