As the newspaper "Kommersant" writes in the material Nikita Korolev and Evgeny Khvostik "Processors in isolation. How the Russian authorities will restart the electronic industry", the growing sanctions restrictions in response to the military actions in Ukraine have exposed systemic problems in the domestic microelectronics. Chip manufacturers were cut off from Taiwanese factories, Western technologies and components. Hundreds of thousands of already paid processors risk simply not getting there, and the only domestic plant capable of producing civilian electronics may be left without materials. The authorities habitually talk about import substitution. But in order to implement it in microelectronics, a country in conditions of technological and economic isolation needs to go through a path in a few years, which Taiwan, which did not have such problems, took decades.

Evgeny Pavlenko (c) Kommersant

Without chips and semiconductors

Already on February 25, the day after Russia launched a special operation in Ukraine, the Export Control Bureau (BIS) of the US Department of Commerce announced export restrictions that will affect semiconductors, computers, telecom equipment, lasers, sensors and equipment in the field of information security. The world's largest semiconductor manufacturer, Taiwan's TSMC, whose facilities produce "Baikal", "Elbrus" and "Scythians", almost immediately stopped deliveries to Russia, The Washington Post reported on February 26, citing a source. On the same day, Taiwan's President Tsai Ing-wen wrote on Twitter that the country "joins economic sanctions against Russia."

Less than a week later, on March 4, BIS switched to point restrictions. It published a list that included the largest Russian players: Baikal Electronics JSC (Baikal processors), MCST JSC (Elbrus processors), STC Modul (Neuro-B calculators), MTC Elvis (Skif mobile processors). Now foreign companies using American technologies are required to request permission from BIS to cooperate with these enterprises, by default, a refusal policy is assumed. In fact, this means that Russian design centers can no longer place orders at Korean and Taiwanese factories.

On March 15, the European Union published a list that included processor manufacturers. European companies will be prohibited from providing Russian entities included in the list with any technological services related to the production of dual-use goods, to issue grants, loans, loans, as well as to provide other financial assistance. But the sanctions will soon expand: on April 5, the head of the European Commission, Ursula von der Leyen, said that the EU would ban the export of semiconductors, machinery and transport equipment to Russia.

However, it is impossible to clearly answer the question of whether the cooperation of design centers of the Russian Federation with foreign factories will continue. Top managers of Russian companies and officials refuse to clarify this both publicly and informally. The only thing they are sure of is that right now there are no negotiations on the placement of chips in Taiwanese factories. "Perhaps the situation will change in a few months," the top manager of the electronics manufacturer hopes.

"We are studying the published documents and developing a plan for further actions. We have not yet received an official notification of the termination of the contract from TSMC," Baikal Electronics told CNews. Not only new orders are in question, but also orders that have already been made. On February 21, Baikal Electronics told Kommersant that about 200 thousand processors were paid for by TSMC, 150 thousand crystals are already ready, but they have to be packaged, another 50 thousand chips should be in production.

The most obvious step for design centers now is to find an alternative factory abroad, ready to produce Russian processors, and redesign them for a new manufacturer. "But the process can take two to three years, during this time it is important not to lose specialists. The logical way out would be to develop processors with topologies of 130-90 nm, their release can theoretically be adjusted on the "Micron". These can be computers for medical equipment or the Internet of Things," believes a source of Kommersant in the IT market.

Meanwhile, Micron, like most players, has been experiencing difficulties with the supply of materials since the beginning of the pandemic. And right now the plant needs at least to adjust and scale the issue of bank and transport cards, to ensure the production of semiconductors at its facilities for equipment needed by Russian oilfield service companies. Back in August 2021, the CEO of Micron, Gulnara Khasyanova, in an interview with Stimul magazine, said that market conditions allowed the manufacturer to raise prices, "but all materials and components have risen in price, and there have also been supply disruptions in a number of positions, for example, with the supply of silicon." To answer the question of Kommersant about how things are now with the supply of materials and production, Micron refused. It is likely that the company uses inventory of materials and calculates new logistics supply chains.

The situation is also complicated by the fact that Russian enterprises, due to sanctions, have lost the opportunity to buy equipment (photolithography, etching installations, etc.) of European, American and Japanese production (ASML, Applied Materials, Canon), adds Sergey Kudryashov, partner of Deloitte's risk Management department in the CIS.

Without a goal and strategy

Experts interviewed by Kommersant believe that the situation was the result of a long absence of a clear state policy in the industry, which would provide for the gradual creation of an independent and self-sufficient production system.

"Until 2020, there was no comprehensive state program that answers the questions of how much to produce microelectronics, for what purposes and from what materials," explains Sergey Kudryashov. The interlocutor of Kommersant in the Russian manufacturer says that the industry has repeatedly turned to the state for financial support for the construction of new and modernization of existing enterprises, as well as localization of production of materials and equipment, but state policy was aimed at subsidizing design centers: "Now Russian design centers have been left with a broken trough, without access to foreign productions and IP blocks (finished parts of processors that Russian developers buy from foreign companies.- "Kommersant") they will develop processors literally on the table."

Pavel Mashevich, Director for Innovative Development of the Center for Collective Use of MIET, partially agrees with this. According to him, until 2020, when the "Strategy for the development of the Electronic Industry of the Russian Federation" was approved, the state policy for the development of the industry was focused mainly on financing design centers, and not on creating a relatively independent ecosystem of electronics, including the production of materials, the development and production of production equipment and the support of promising personnel.

"I think that in the late 1990s and early 2000s, the state did not have enough resources to support the industry comprehensively, it was important to understand what we could save. Then it was decided to support design centers that were engaged in designing microprocessors," says Mr. Mashevich. According to him, the goal was to preserve the scientific school and train personnel.

Work on a comprehensive strategy for the development of the electronic industry, says Pavel Mashevich, began in 2008 - then Yuri Borisov was appointed Deputy Minister of the Ministry of Industry and Trade: "The financing of development work has begun, they started talking about the need to build their own factories, financial flows have gone into microelectronics." But factories capable of producing semiconductors for civilian electronics have not appeared. Undertaken 18 years ago, in fact, the only attempt to launch the production of Angstrom-T failed.

The authorities returned to the idea of launching semiconductor factories in Russia only in January 2020 - these plans were outlined in the "Strategy for the Development of the Electronic Industry of the Russian Federation until 2030", published on the government's website. The "Goals" column describes plans to create "silicon factories operating in the foundry service mode (the possibility of mass production of semiconductor components and devices) for the production of digital integrated circuits with topological standards of 28 nm, 14-12 nm, 7-5 nm". These plans could be specified in the national project in the field of radio electronics, which the authorities started working on a few weeks before the outbreak of hostilities in Ukraine.

Dominator Island

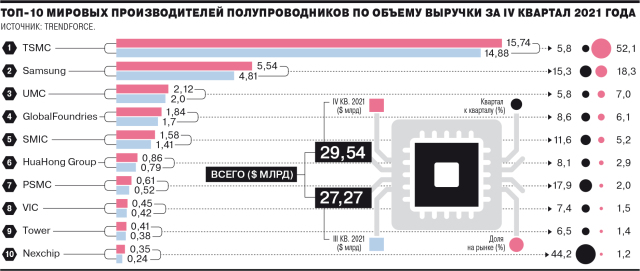

However, even before the sanctions, the idea looked extremely bold: the state, together with the industry, decided to follow a path that took decades for the global leader of the semiconductor market, Taiwan. The share of TSMC alone in the market is about 52%, while the nearest competitor, South Korean Samsung, has only 17.1%. The share of Taiwan in the global semiconductor production is 63%.

Such results were achieved largely thanks to the long-term efforts of the government and a number of Chinese immigrants who left communist China for the United States, where they received education and work experience in large companies, in order to help Taiwan create a new industry many years later.

Historically, the island of Taiwan, where the authorities had already carried out large-scale industrial development reforms in the 1960s, was very dependent on the supply of fuel and other resources. The oil crisis that broke out in 1973 hit the industry hard, and the government decided to diversify the economy by setting up the production of semiconductors, which were then in growing demand due to consumer electronics. On the basis of a specially created Institute for Industrial Technology Research (ITRI) in 1973, it was decided to launch the production of semiconductors in the country using RCA technologies.

It took almost four years to build the first enterprise. As part of the first stage of the state program, a total of $ 10 million was spent on the launch of production from the government of the country and RCA. The first plant started operating in 1977 under the auspices of ITRI. Three years later, the government created United Microelectronics Corporation (UMC), with an initial investment of $12.5 million. In the early 1980s, the second stage of the program was launched with an investment of about $22 million.

In 1987, with the help of the state, another company was founded - Taiwan Semiconductor Manufacturing Company (TSMC). The Dutch electronics manufacturer Philips Electronics NV entered the capital with a 28% share, it became the second shareholder after the government and provided technologies and equipment for the production of 1.5 micron semiconductor nodes - at that time it was about two generations older than the top market offerings.

In the late 1980s, amid the rapid growth of South Korean electronics manufacturers Samsung, Hyundai and Goldstar (now LG), the government of Taiwan launched the third stage of the semiconductor industry development program with investments of $72 million. The turnover and share of the Taiwanese semiconductor industry grew. In 1995, total sales were estimated at only $3.3 billion, which was only 2.5% of the global volume. A year later, they reached almost $5 billion (3% of the global volume), by 2000 they had grown to $17 billion (6%). Thus, it took about 30 years for Taiwan to create a semiconductor production almost from scratch and take a solid position on the world market.

Lagging and catching up

With a delay of about 40 years, mainland China decided to follow the path of Taiwan. The Made in China 2025 import substitution program, adopted back in 2015, included initiatives to urgently create new capacities for semiconductor production in China. The catalyst, as in the case of the Russian Federation, was the US sanctions imposed in 2017-2019. Chinese smartphone manufacturers - mainly Huawei and ZTE - have been cut off from the usual semiconductor supply channels. According to the plan, the share of components made in China in Chinese goods should reach 70% by 2025. The total amount of public investment in the Made in China 2025 program has already reached $1.4 trillion.

Forcing the program led to the fact that the Chinese authorities began to actively involve third-party specialists. According to Western and Taiwanese media, more than 3 thousand Taiwanese engineers and developers have recently left for China - this is about a ninth of their total number in Taiwan itself.

However, Russia, officials and market participants interviewed by Kommersant admit with one voice, will not be able to repeat China's experience in a short time. To do this, we will have to rework all the plans for the development of the industry. "The current regulatory framework should simply be thrown into the trash and a new one should be written," emphasizes the interlocutor of Kommersant in the government. According to Kommersant sources, 22 working groups are currently working on the preliminary concept of a new national project for the development of the industry. Its implementation is estimated at 0.6-1 trillion rubles.

Moreover, experts believe that regardless of the amount of state influence, it will not be easy to realize the task of developing the Russian microelectronic industry. "For objective reasons, it is impossible to fulfill the task of complex development of the industry in a short time, from materials and equipment to factories and final products," says Valery Dshkhunyan, ex-director of Roselectronics, Candidate of Technical Sciences. It is necessary to establish cooperation with those countries and companies that will be able to supply materials for production in the near future, he notes. "If we talk about machine tool construction, then we need to follow the path of China and partially engage in the reproduction of foreign technological ideas using the post-Soviet scientific school," the expert adds. We cannot repeat the mistakes when we developed products just to get money, insists the interlocutor of Kommersant in the electronics market: "We need to form a state request to the microelectronic industry and act strictly according to it, providing in advance which products are needed and which are not. It is also necessary to move away from the policy of supporting design centers and direct money to the creation of production facilities. Design centers will grow around them on their own." In his opinion, the technological and economic isolation of the country can contribute to the process if it leads to a serious decline in prices for metals, oil and gas: a microelectronic factory is an energy-intensive production. This advantage is theoretically able to attract potential partners, for example Chinese.

(c) Kommersant