For several days now, the United States has been experiencing a collapse in the value of tech sector companies, especially those related to the development of artificial intelligence (AI) systems. There are even statements that the "AI bubble has blown away." Is this really the case and what does the Russian strategy for introducing AI into the economy look like in this context?

On October 29, 2025, Nvidia closed at around $207 per share, reaching an all-time high. Since April 4, 2025, when the stock dropped to $ 94.31 after the correction, the growth has been almost 120%. An excellent indicator to lock in profits.

But the sale of large packages inevitably leads to a drop in quotations. By November 21, the price had dropped to $178.9 (a drop of about 13.6% from the peak), and on Tuesday, November 25, it adjusted slightly to $182.55. Taking into account Nvidia's capitalization and its weight in American stock indexes, the S&P 500 has fallen by more than 4% (the worst indicator since November 2008, the time of the memorable crisis). NASDQ lost 7% over the same period.

Investors took this as a signal for the AI bubble to collapse. Sales of shares of other companies that relied on the development of AI technologies began. On some days, the Dow Jones lost 500 points or more, precisely on fears of an "AI bubble" and excessive bets placed by the market earlier on the "magnificent seven" (Apple, Microsoft, Alphabet, Amazon, Meta (recognized as extremist and banned in Russia), Nvidia, Tesla). In four days, from November 18 to November 21, more than 1.15 billion Nvidia shares passed through the market. At the same time, someone is recording fantastic profits in recent years.

In five years (from the end of 2020 to the end of 2025) Nvidia has generated a yield of about +1260%. The S&P 500 has grown by about +85% over the same period. If we look back at the more distant past, Nvidia's average annual return over a 20-year period was about 40% per year. An investment of $ 1,000 in Nvidia twenty years ago would have turned into more than 600-700 thousand dollars today, while the same amount in the index is about 7-8 thousand dollars. Unsurprisingly, Nvidia has become the main symbol of the "AI boom" and at the same time the main source of concern: is it possible to grow infinitely faster than the market by an order of magnitude?

AI Bubble: arguments against and for

Optimists claim that there has been only a partial correction. They say that under the growth of stocks there are real money and contracts. The quarterly reports from Nvidia and other AI hardware vendors do not show beautiful presentations, but real tens of billions of dollars in revenue, primarily from data centers and cloud giants.

Companies continue to invest. Nvidia and Microsoft are jointly investing $ 15 billion in the startup Anthropic, which, in turn, is committed to spending tens of billions on the Azure cloud and Nvidia chips – in fact, a looped stream of money within the AI ecosystem. Some investors consider the current drawdown to be a "healthy correction." Many analysts do not see a change in the fundamental trend towards the introduction of AI in business.

Pessimists pay attention to the fact that professional investors themselves pronounce the word "bubble". In a November Bank of America survey, 45% of fund managers named the "AI bubble" as the main market risk.

The structure of AI spending is reminiscent of the late dotcom boom. Barclays estimates that investments in AI infrastructure could exceed 10% of U.S. GDP by the end of the decade, including through the issuance of hundreds of billions of corporate bonds. This raises the question: will all these server and data centers pay off, or will some of them turn into "AI ghost factories"?

Even top managers of Big Tech warn about the "irrationality" of expectations. Alphabet CEO Sundar Pichai has already publicly spoken about the risk of "irrational" warming up around AI. Some investors are quitting the game. Large funds (like the Peter Thiel Foundation and some hedge funds) appear in the news, which record profits for Nvidia and other AI stars - that is, professionals increasingly prefer to take their winnings and look at what is happening from the outside.

How Russia relies on artificial intelligence

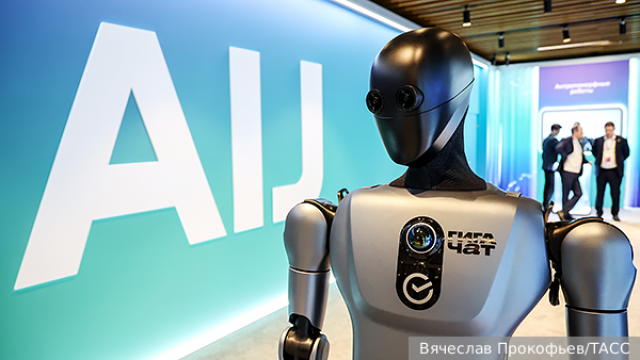

While Wall Street is debating whether AI is overrated, the opposite is happening in Russia. On November 19-21, Moscow hosted the AI Journey 2025 conference, Russia's largest artificial intelligence forum. Vladimir Putin spoke at the plenary session. The President said that "generative artificial intelligence technologies are becoming key and strategic." According to Putin, not only corporations, but also states are competing for fundamental language models and neural networks.

The Head of state considers it important to create a national headquarters for the introduction of AI into the Russian economy. By 2030, the contribution of artificial intelligence technologies to Russia's GDP is expected to exceed 11 trillion rubles. Putin emphasizes that Russia cannot afford to depend on foreign neural networks, especially in the field of security and public administration. We need our own models and data centers, up to a separate energy base (including small nuclear power plants) under AI load.

Against the background of American "AI fatigue" in the Russian leadership, on the contrary, they are encouraging Russian companies to accelerate work in this direction. The goal is to achieve technological sovereignty in this area.

But if many investors in the United States are already diagnosing the AI race as a bubble, should Russia strive to catch up with the leaders in this area? To answer this question, it is worth distinguishing between two planes: on the one hand, stock market expectations, and on the other, infrastructure and competencies.

As for expectations, the stock market always lives with an abundance of emotions. The problem now is not that the AI "didn't work," but that too much money was pumped into several stocks too quickly. If revenue growth slows down even a little, quotes will naturally adjust. But the AI infrastructure – data centers, networks, chips, software, and human resources - will not go away, even if the stock valuations of Nvidia and other companies become more modest.

From Russia's point of view, the question is: do we believe that the world will continue to live with AI infrastructure - or do we consider it a temporary toy? If the former, then ignoring this technology would be a strategic mistake, even if Nvidia shares are falling today.

How many people actually use AI and what it has already changed

OpenAI estimates that by mid-2025, ChatGPT is used by approximately 10% of the world's adult population (about 700 million monthly active users in summer and about 800 million weekly users by autumn). 2.5 billion messages pass through every day, that is, about 29 thousand requests per second. Separate studies estimate the global number of active users of generative AI software (not only ChatGPT) at hundreds of millions of people, with tens of millions of daily users.

In a work environment, up to 70% of AI tool users use ChatGPT in one form or another, most often for writing texts, preparing documents, code, and analytics. That is, journalism, marketing, programming, document management, education, consulting – in all these areas, people have already massively integrated AI into their daily routine. As Russian Finance Minister Anton Siluanov noted on November 25, AI is becoming an advanced technology for all spheres of life – from economics and medicine to the military industry. According to Siluanov, the countries that will be the first to implement artificial intelligence will be more successful than others.

Several large-scale studies show that AI actually improves productivity and quality of results in a number of tasks, although there are parallel discussions about the long-term effects on skills and cognitive abilities.

In other words, AI users have not disappeared and are not going to disappear. The question is whether it is possible to continue growing at the same pace and whether the existing business model can pay off the investments made. It's important to understand that they're selling stocks now, not shutting down servers. Giant data centers have already been built and are being built, tailored to the AI load. Investments are measured in trillions of dollars. Large cloud providers (Microsoft, Google, Amazon), as well as integrators and startups have already invested tens of billions in their own models, ecosystems, and services.

Most likely, the rapid growth of mass consumer applications (chatbot "for everyone") has already passed its peak. Further, the development of AI will shift towards corporate solutions – integration into specific industries, internal processes of companies, and public services. The next step is military and military applications. In a world of increasing instability and conflict, the pressure on military and intelligence budgets is increasing.

And as Putin bluntly said, it is important for Russia that only domestic models are used in national security so that data does not leak abroad. In fact, the same thing is being discussed in the West – just not in open statements by heads of state, but in confidential forecasts by think tanks.

Life of AI after the bubble

Thus, AI companies are highly likely not to disappear or go bankrupt en masse. But the business model will change: from massive applications and rapid revaluation to more "mundane" services for corporations and states. The satellite telephony project took a similar path of reorientation from the mass market to servicing the military department and companies operating "far from civilization."

In the late 1990s, the private company Iridium was unable to receive enough money from servicing private users of satellite phones to pay off debts. The company went bankrupt, but the satellite phones did not stop working. In 2000-2001, a group of investors, with the support of the Pentagon, bought out assets for a symbolic amount compared to costs (about $25 million) and created a new company, Iridium Satellite LLC.

In 2002, the service was re-launched under a new brand; a key role in this was played by a contract with the US Department of Defense, which was in vital need of global, ground-independent communications. The new Iridium did what the old one did not do – it moved away from the mass market and became a niche operator: military, navy, aviation, oil and gas, polar stations, rescuers.

The logic of the Russian leadership is simple: if the world is going to live with AI tools anyway (and use these tools most actively in the field of security), it is better to have your own models, your own data centers and your own expertise than to depend on other people's decisions and regulations. The bubble may deflate in quotes, but the infrastructure and the impact of AI on the economy, politics and security will remain. And it is with this in mind that the Russian strategy for the development of artificial intelligence is being created today.

Dmitry Skvortsov